$300 Ctc 2025 Irs Update. In 2025 the irs is expected to make a $300 direct deposit payout on the 15th of each month to those who are under 6 and those who aged 6 to 17 will expect to receive $250. Some reports claim that in 2025, the internal revenue service will provide $300 for taxpayers with children under the age of 6 and $250 for children between the ages of 6.

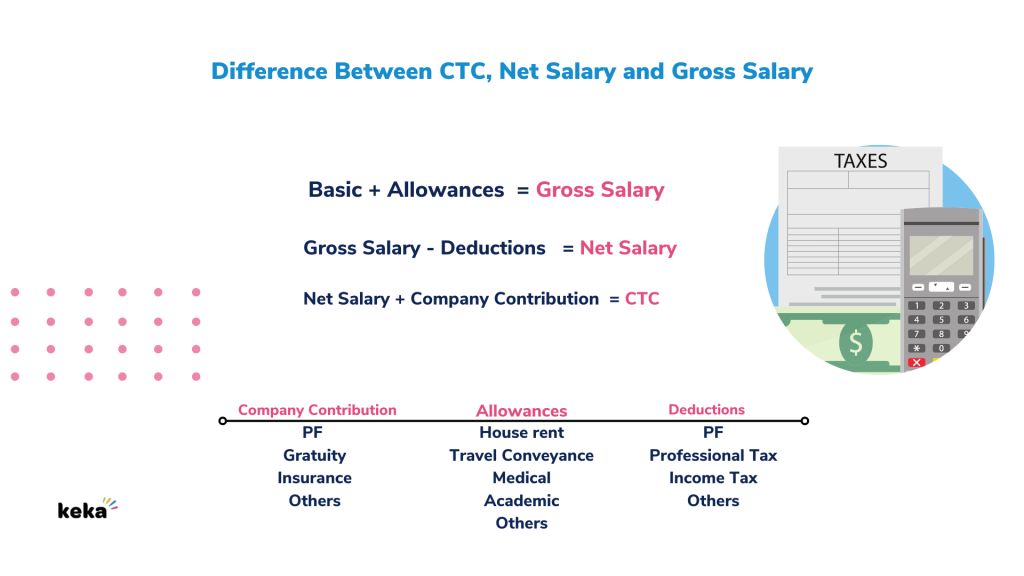

Currently, a portion of the child tax credit is only refundable if you owe federal income tax. For youngsters under six, the irs will start to payout a $300 direct deposit on the 15th of every month starting, if approved by the federal government.

How To Calculate Additional Ctc 2025 Irs Abbye Elspeth, Each qualifying dependent under 17 now receives a. A $300 direct deposit payment has been made by the internal revenue service (irs) in april 2025 to assist families across the united states.

Irs Ctc For 2025 Alysia Sharon, You qualify for the full amount of the 2025 child tax credit for each qualifying child if you meet all eligibility factors and your annual income is not more than. Each qualifying dependent under 17 now receives a.

Irs Ctc 2025 Reyna Clemmie, The internal revenue service and the treasury department will automatically start paying millions of american families the “irs gov $300 direct deposit payment 2025” child tax. The child tax credit (ctc) allows eligible families to reduce their federal income tax for.

Irs Refund Schedule 2025 Ctc Toni Agretha, Eligible families will receive a payment of up to $300 per month for each child under age 6 and up to $250 per month for each child age 6 and above. For children under six, families will receive $300 per.

When To Expect Tax Refund With Child Credit 2025 Feb 2025 Calendar, Learn about the 2025 $300 ctc monthly payments, eligibility, and how to claim. You qualify for the full amount of the 2025 child tax credit for each qualifying child if you meet all eligibility factors and your annual income is not more than.

300 Direct Deposit Payment Date 2025, Know CTC Eligibility & How To, How much is ctc 2025 jean robbie, households covering more than 65 million children will receive the monthly ctc payments through direct. Currently, a portion of the child tax credit is only refundable if you owe federal income tax.

How To Calculate Additional Ctc 2025 Irs Datha Cosetta, Direct deposit will be used by the child tax credit program to. For youngsters under six, the irs will start to payout a $300 direct deposit on the 15th of every month starting, if approved by the federal government.

Irs Ctc 2025 Reyna Clemmie, Some reports claim that in 2025, the internal revenue service will provide $300 for taxpayers with children under the age of 6 and $250 for children between the ages of 6. The internal revenue service and the treasury department will automatically start paying millions of american families the “irs gov $300 direct deposit payment 2025” child tax.

Irs Refund Schedule 2025 Ctc Emyle Karalynn, This program aims to give financial help to families with children. Some reports claim that in 2025, the internal revenue service will provide $300 for taxpayers with children under the age of 6 and $250 for children between the ages of 6.

All qualified individuals should be able to begin receiving the ctc monthly payments 2025 from the irs on july 15, 2025.